She didn’t respond because she thought it odd that the bank would not have her information anyway. I haven’t personally seen any yet in this space although just over the weekend I was out to dinner with a friend who said she got an email from her bank asking her to verify all of her account information.

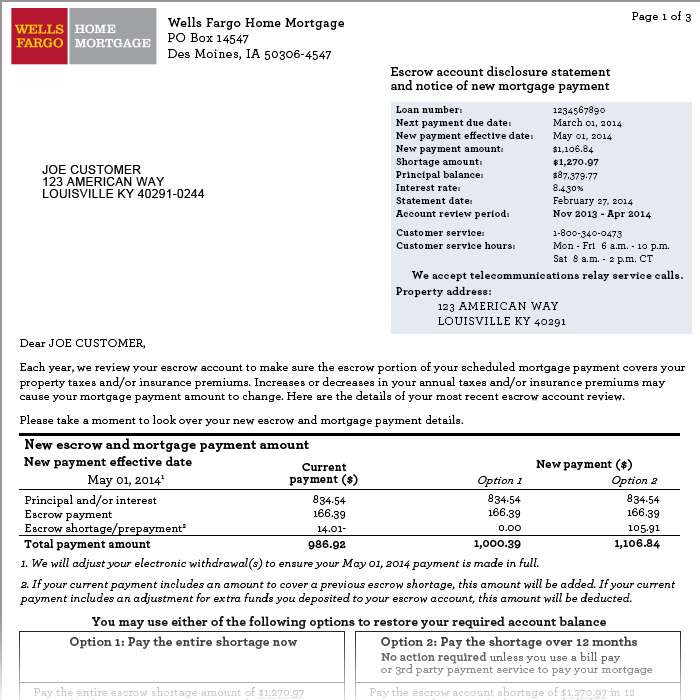

“There is, unfortunately, a lot of fraud in general. Wells Fargo is aware that fraud continues to be a concern for most. You’ll then have $3,000 placed in a non-interest bearing account that will be due at the end of your mortgage, such as if you pay off your mortgage or refinance,” Bell said. “An example of a partial claim would be your payment was $1,000 per month. Some guidelines will extend the term of the loan by the three months of the forbearance, while others will do a partial claim in which the missed payments are added to the end of the loan as a balloon payment. She said Wells Fargo would follow specific investor guidelines and their own portfolio to make the repayment process easier when customers are ready to resume payments. However, Bell added that many might not choose that option because the pandemic has left many in a financial bind. Bell said Customers will have options based on their specific investor on their loan which They may have the option to do a repayment plan, so taking the three months of missed payments and adding them to your next 3 to 6 months of payments.” “In June, we will be reaching out to customers who received initial 3 months of forbearance that will be expiring to provide them options to extend forbearance additional 3 months if they still need more time to recover or if they are ready to resume making payments we will provide them options to make up the suspended payments. Many customers weren’t initially sure, how the pandemic, and government officials began might affect them publicly encouraging everyone to call their mortgage provider, Bell said.

#Wells fargo online mortgage payment series#

0 kommentar(er)

0 kommentar(er)